Page 86 - Sürdürülebilir Savunma

P. 86

INCENTIVES

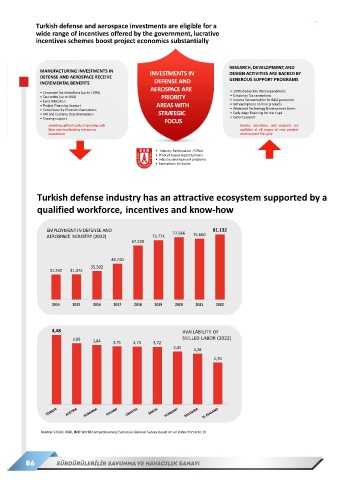

Turkish defense and aerospace investments are eligible for a

wide range of incentives offered by the government, lucrative

incentives schemes boost project economics substantially

RESEARCH, DEVELOPMENT, AND

MANUFACTURING INVESTMENTS IN INVESTMENTS IN DESIGN ACTIVITIES ARE BACKED BY

DEFENSE AND AEROSPACE RECEIVE GENEROUS SUPPORT PROGRAMS

INCREMENTAL BENEFITS DEFENSE AND

AEROSPACE ARE

• Corporate Tax deductions (up to 100%) • 100% deductible R&D expenditures

• Tax credits (up to %90) PRIORITY • Corporate Tax exemptions

• Land Allocation • Income Tax exemption for R&D personnel

• Project Financing Support AREAS WITH • VAT exemptions on final products

• Social Security Premium Exemptions • Dedicated Technology Development Zones

• VAT and Customs Duty Exemptions STRATEGIC • Early stage financing for start-ups

• Training support FOCUS • Export support

Lowering upfront costs, improving cash Grants, incentives, and supports are

flow, and accelerating returns on available at all stages of new product

investment development life cycle

• Industry Participation / Offset

• Product based supports/loans

• Industry development programs

• Exemptions for duties

ECOSYSTEM

Turkish defense industry has an attractive ecosystem supported by a BREAKDOWN OF EMPLOYMENT IN

DEFENSE AND AEROSPACE INDUSTRY

qualified workforce, incentives and know-how (2022)

EMPLOYMENT IN DEFENSE AND 77.566 81.132

AEROSPACE INDUSTRY (2022) 73.771 75.660 8.729

67.239

23.349

12.448

44.740 81.132

35.502

31.242 31.375

36.095

2014 2015 2016 2017 2018 2019 2020 2021 2022

4,48 AVAILABILITY OF QUALIFIED ENGINEERS (2022)

3,95 3,84 3,75 3,73 3,72 SKILLED LABOR (2022) 5,92 5,77 5,59

3,42 3,28 5,39 5,18 4,99 4,96 4,77

2,70 4,23

Source: SASAD, IMD, IMD World Competitiveness Executive Opinion Survey based on an index from 0 to 10

86 SÜRDÜRÜLEBİLİR SAVUNMA VE HAVACILIK SANAYi